Taxation & Welfare

Governments cannot pay for quality public services or social protection for the poor unless they have dependable streams of revenue. Can policy innovations fast-track improvements to tax capacity, and strengthen the compact between citizens and the state?

Governments cannot pay for quality public services or social protection for the poor unless they have dependable streams of revenue. Can policy innovations fast-track improvements to tax capacity, and strengthen the compact between citizens and the state?

Highlights

News, events, and insights from our policy-research engagements on building the capacity of governments to generate revenue.

Research by Anders Jensen examines the modern tax system that emerges as a country's economy progresses.

Social safety nets worldwide routinely come under attack by critics wielding an argument that is as misleading as it is familiar.

The Spring Issue article features interviews with Rema Hanna, Asim I. Khwaja, and Charlotte Tuminelli.

Projects

Can linking tax collection to social services increase public revenue in Pakistan?

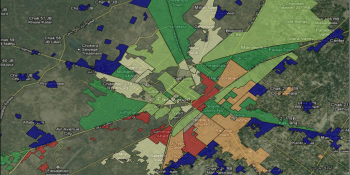

How do incentives impact property tax officials and citizen tax compliance?

Understanding potential for strengthening consumers’ participation in VAT compliance strategies.

Examining Zambia’s efforts to collect taxes from a broader base of small businesses and individuals.

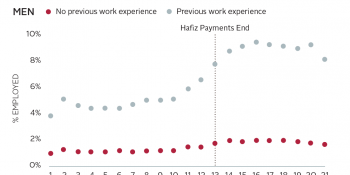

How does an unemployment assistance program impact job searches for program beneficiaries?

Examining the impact of technology on local tax officials’ behavior, cost of collection, and overall revenue performance.