One In A Melon: How to signal quality in a market of counterfeit foods

The FDA’s “Defect Levels Handbook” is not the most appetizing literature before a meal or a trip to the grocery store (for example, the FDA allows only 450 insect parts and nine rodent hairs in every 16 oz. box of spaghetti), but it is part of America’s extensive system of food safety and inspection that allows the typical American household to enjoy one of the highest quality food supply systems in the world (it could be much worse than 450 insect parts and nine rodent hairs). The quality - as well as how much we trust the quality - of the food we regularly buy has important economic consequences. This is especially apparent in low- and middle-income country (LMIC) contexts, with informal and semi-formal markets, where systems of food safety are not as extensive or yet to exist.

Jie Bai’s recent paper, Melons as Lemons: Asymmetric Information, Consumer Learning and Seller Reputation, takes us to the retail watermelon markets on the other side of the globe, in Shijiazhuang, China, to better understand how to incentivize higher-quality food products in LMICs. In China, watermelons are one of the most popular summer fruits, making 35% of household summer fruit consumption. And as in many LMIC contexts, semi-formal, open-air, highly-localized markets are common for selling fresh food products, with many small-scale retailers selling side by side.

The Market for Melons: Low-Trust-Low-Quality Equilibrium

But despite a growing middle class’s willingness to pay for higher quality food products, and the ability for firms to sell quality food products and build their reputation, the watermelon market is stuck in a bad equilibrium that results in a missed opportunity for consumers to eat better and producers to earn higher profits--Bai estimates a total welfare loss of 66%. The underlying economic forces behind this bad equilibrium are unfortunately common in developing countries: small firm size, asymmetric information, and widespread mistrust. This is essentially an information problem.

Bai models the watermelon market as a game between a long-run seller and an infinite sequence of potential buyers, in which there are significant information frictions that lead to a lack of incentive to provide quality goods and build a better reputation for quality:

-

The seller’s quality cannot be observed by buyers at point of transaction. Watermelons are a typical experience good, a good with characteristics (such as how sweet a watermelon is) that are difficult to observe before consumption. The seller’s claim of high quality, therefore, cannot be immediately verified and buyers need to learn it from past consumption experiences.

-

Buyers have pessimistic beliefs about quality due to past bad behavior. Chinese consumers are often skeptical of domestically produced food products because of pervasive counterfeiting and quality scandals in Chinese food markets in the past, replete with exploding watermelons in 2011. (Other examples include fake salt, rice contaminated with heavy metals, and baby formula with lethal amounts of industrial chemicals.)

-

Reputation for quality goods, and therefore buyers’ trust, takes a long time to build.

-

It is costly, in terms of time and effort, for sellers to sort and source high quality watermelons, especially within a disorganized supply chain.

-

Quality is not priced (there is no quality price premium). At baseline, no seller consistently offers sweet watermelons and charges a price premium for it.

The Experiment: Inducing Quality Provision and Reputation Building through Signaling Technology

Within a watermelon market that is stuck in this low-trust-low-quality equilibrium, Bai introduces a model of reputation building that has the potential to shift market outcomes from a bad equilibrium to a more optimal one. She proposes that it is possible to trigger quality provision by introducing a credible quality-signaling technology that can enhance consumer learning and incentivize sellers’ reputation building. Bai’s proposed quality-signaling technology is a label.

In her experiment she uses two kinds of labels:

-

A sticker label that is widely used and easily fabricated, or

-

A new expensive laser-cut label, in which the words “premium watermelon” (or “Jing Pin Xi Gua” in Mandarin Pinyin) are laser engraved. The high up-front fixed cost of the novel laser-cut label would lend credibility and deter counterfeits, functioning similarly to certification by a trusted third-party.

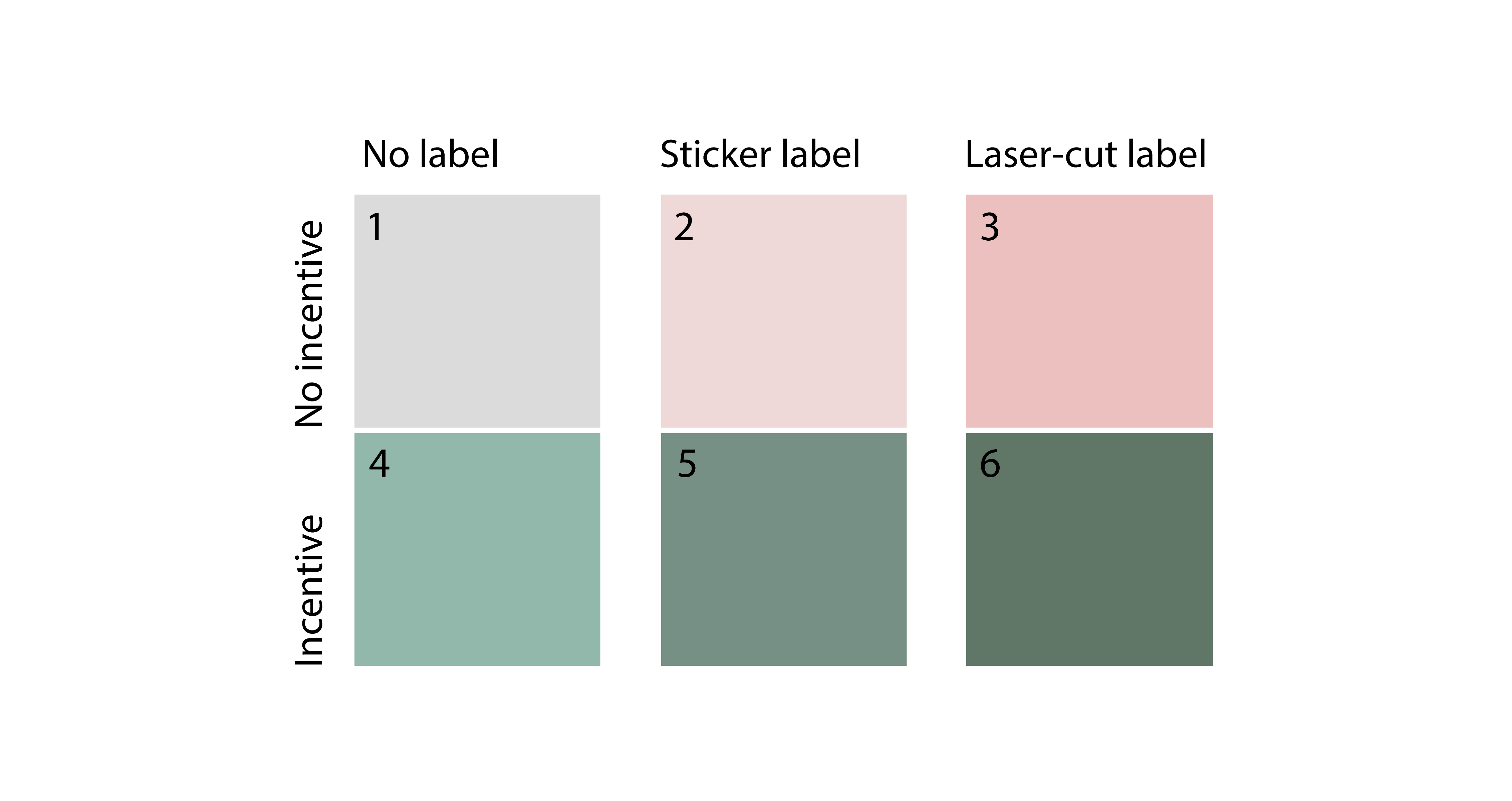

Bai then works with 60 sellers in 60 different markets in Shijiazhuang, randomly introducing the two kinds of signaling technology “treatment,” the sticker label to 30 sellers, and the expensive laser-cut label to another 30 sellers, with the remaining 30 sellers as the label-free baseline or “control.”

Additionally, she cross-randomized a subset of sellers (a randomly selected half of the sticker label group, the laser cut label group, and the label-free group) with an incentive treatment. This incentive treatment was a temporary monetary incentive to maintain high quality watermelons, which subsidized the initial cost of reputation building. Bai then collected data on both the supply and demand side, sellers’ quality, pricing and sales and household purchase and consumption.

There were six different treatment arms in total:

Three Main Findings

-

The laser-cut label induced sellers to provide higher quality. This suggests that the new signaling technology enhances consumer learning and strengthens sellers’ incentive to build reputation. The sticker label did not result in provision of higher quality. This suggests that consumers are hesitant to upgrade their perceptions based on sticker labels, making this method of reputation building a low-return investment.

-

Incentive treatment successfully motivated sellers to provide higher quality but this was sustained only for the laser label + incentive group.

-

In terms of sales outcomes, the sticker label group did the same as the baseline label-free control group, while the laser-cut label group earned 30-40% higher sales profits on average. This demonstrates that there is a high demand for quality and having a reputation for quality can pay off. However, the resulting increase in profits from reputation building was not enough to offset the fixed cost of the laser-cut label signaling technology for small individual sellers.

Policy Implications

Bai’s findings are relevant in informing policy interventions that seek to encourage quality upgrading to improve market efficiency. Even though markets may improve on their own as countries develop, and demand for quality continues to rise until firms eventually find it profitable to start building reputation, good reputation sometimes emerges only after long periods of time, and the transition to higher quality goods can take even longer if the country’s growth rate is slow.

Bai’s experiment with signaling technologies demonstrates that overcoming the information problem with a quality-signaling technology, thereby facilitating reputation-building, can yield fruitful (pun intended) returns. Similarly, policies that subsidize reputation-building may be able to pull the market out of a bad equilibrium. Her work highlights an opportunity for potential interaction between a reputation mechanism and government-led brand protection measures in building trust among consumers and incentivizing firms to provide high quality goods. Perhaps Shijiazhuang will one day have a reputation for selling the sweetest watermelons summer has to offer. All it will take is a label.