Education Financing

Education Financing

LEAPS is experimenting with offering schools

innovative financial products that can help

them meet the needs of their students. We are

watching the effect on children’s test scores.

LEAPS is experimenting with offering schools

innovative financial products that can help

them meet the needs of their students. We are

watching the effect on children’s test scores.

Schools need resources to implement innovations, yet a major constraint for public and private schools in Pakistan is a lack of adequate resources. In public schools, principals have limited access to resources to address their schools’ needs. In private schools, owners are limited by their schools’ revenues. Alleviating these resource and financing constraints helps schools to address their specific needs, thus improving quality.

Current Research

A large literature on credit constraints in small and medium enterprises shows how the inability to borrow can hurt firm expansion and profitability. We apply this framework to public and private schools and seek to examine both the importance of these resource constraints and how alleviating them impacts learning and other educational outcomes. Moreover, since schools compete with each other in a given market, an important aspect of our work in this area is to look at the system wide impact of alleviating the resource constraints of one provider on all other providers and other key actors in the educational ecosystem.

We address these questions with three large scale randomized controlled trials.

1. Increasing Funds to Public Schools

The first evaluates the effects of a government reform that led to a large increase in the funds available to locally run public school management committees. Work on this is ongoing.

2. Unconditional Cash Grants to Low Cost Private Schools

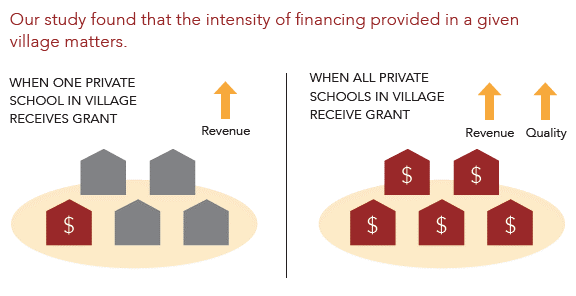

Our second study examines the impact of unconditional cash grants to low cost private schools (LCPS). In collaboration with the Aman Foundation and Tameer MicroFinance Bank (TMFB), we offered cash grants worth roughly 500 USD each to 855 schools in rural Punjab. This grant value was equivalent to about two months’ worth of revenues and half a year worth of profits for the median school. The grants were offered in two forms: "low saturation", where only one (randomly selected) school in a selected village was offered the grant, and “high saturation,” where all LCPS in the village were offered the grants. We find that when all schools in a village receive financing (as opposed to just one school) they begin to invest in quality of education rather than fixed investments, to remain competitive in the village’s educational marketplace.

Read More

Upping the Ante: The Equilibrium Effects of Unconditional Grants to Private Schools

3. Financial Products for Low Cost Private Schools

For our third study in education financing, we partnered with Telenor Bank (previously Tameer Microfinance Bank) to design and evaluate promising financial products for low cost private schools, ultimately the only sustainable way to make financial resources accessible to schools at scale in Pakistan. We piloted a loan product and a micro-equity product, both specifically tailored to the needs of low cost schools. We aim to examine the effect of school financing on test scores, enrollment and financial metrics. This study is ongoing. Key outcomes to be examined include increased investment, increased enrollment, hiring of additional teachers and staff and/or improvements in quality of education.